Present Value Calculator

Present Value is:

$0.00

$0.00

This is the amount of money you expect to receive or owe in the future. Be precise with this number. For instance, if you're analyzing an investment that promises to pay you $20,000 in ten years, then $20,000 is your future value. If you're evaluating a loan with future repayment obligations, you'd input the total amount you expect to repay.

This refers to the number of time intervals until you receive or pay the future value. These periods can be years, months, quarters, or any other consistent time frame. It's crucial to match the period unit with the interest rate you'll input in the next step. If your interest rate is annual, your periods should be in years. If it's monthly, your periods should be in months.

This is arguably the most critical input. The discount rate, often referred to as the interest rate or required rate of return, represents the rate at which future cash flows are discounted to their present value. This rate reflects the opportunity cost of capital, inflation, and the risk associated with the investment or financial obligation. A higher discount rate will result in a lower present value, as future money is deemed less valuable. Conversely, a lower discount rate will yield a higher present value.

<h2>Unlock the Future Value of Your Money: Your Essential Present Value Calculator</h2>

<p>In the dynamic world of finance and investment, understanding the true worth of future money today is paramount. Whether you’re a seasoned investor, a business owner strategizing for growth, or simply an individual planning for long-term financial goals, grasping the concept of “time value of money” is crucial. This is where the power of a <strong>Present Value Calculator</strong> comes into play. It’s not just a financial tool; it’s your key to making informed, strategic decisions by translating future sums into their equivalent worth right now.</p>

<p>At its core, the time value of money suggests that a dollar today is worth more than a dollar tomorrow. This is due to a multitude of factors, including inflation, the potential for earning interest (opportunity cost), and the inherent risk associated with receiving money at a later date. Our intuitive <strong>Present Value Calculator</strong> is designed to demystify this principle, providing you with a clear and actionable understanding of how much a future payment is truly worth in today’s terms.</p>

<p>Why is this so important? Imagine you’re offered two investment opportunities. One promises a fixed sum of $10,000 in five years, while the other offers $8,000 in two years. Without a <strong>Present Value Calculator</strong>, making a direct comparison can be challenging. You need to account for the time value of money to see which opportunity offers the better return on your investment. Our calculator makes this comparison straightforward, empowering you to choose the path that maximizes your financial well-being.</p>

<h3>The Power of Present Value: More Than Just a Calculation</h3>

<p>The applications of a <strong>Present Value Calculator</strong> extend far beyond simple investment comparisons. Consider these scenarios:</p>

<ul>

<li><strong>Investment Analysis:</strong> Evaluating the profitability of long-term investments, bonds, and stocks. By discounting future cash flows back to their present value, you can determine if an investment is truly worth its asking price.</li>

<li><strong>Business Valuation:</strong> For businesses, understanding the present value of future earnings is critical for accurate valuation, mergers, acquisitions, and attracting investors.</li>

<li><strong>Loan and Mortgage Decisions:</strong> Comparing different loan offers by calculating the present value of future payments can reveal hidden costs and help you secure the most favorable terms.</li>

<li><strong>Retirement Planning:</strong> Estimating how much you need to save today to achieve your desired retirement income in the future.</li>

<li><strong>Lease vs. Buy Decisions:</strong> Determining the financial advantage of leasing an asset versus purchasing it outright by comparing the present value of lease payments to the purchase price.</li>

<li><strong>Settlement Negotiations:</strong> In legal or insurance contexts, calculating the present value of a future settlement amount is essential for fair compensation.</li>

</ul>

<p>As you can see, the <strong>Present Value Calculator</strong> is an indispensable tool for anyone looking to make sound financial decisions, whether personal or professional. It provides a quantitative basis for comparing financial opportunities across different time horizons.</p>

<h3>How Our Present Value Calculator Works: A Simple Three-Step Process</h3>

<p>We’ve designed our <strong>Present Value Calculator</strong> to be incredibly user-friendly, so you can get the insights you need without complex financial jargon. Here’s how it works in three simple steps:</p>

<h4>Step 1: Input the Future Value</h4>

<p>This is the amount of money you expect to receive or owe in the future. Be precise with this number. For instance, if you’re analyzing an investment that promises to pay you $20,000 in ten years, then $20,000 is your future value. If you’re evaluating a loan with future repayment obligations, you’d input the total amount you expect to repay.</p>

<h4>Step 2: Specify the Number of Periods</h4>

<p>This refers to the number of time intervals until you receive or pay the future value. These periods can be years, months, quarters, or any other consistent time frame. It’s crucial to match the period unit with the interest rate you’ll input in the next step. If your interest rate is annual, your periods should be in years. If it’s monthly, your periods should be in months.</p>

<h4>Step 3: Enter the Discount Rate (Interest Rate)</h4>

<p>This is arguably the most critical input. The discount rate, often referred to as the interest rate or required rate of return, represents the rate at which future cash flows are discounted to their present value. This rate reflects the opportunity cost of capital, inflation, and the risk associated with the investment or financial obligation. A higher discount rate will result in a lower present value, as future money is deemed less valuable. Conversely, a lower discount rate will yield a higher present value.</p>

<p>Once you’ve entered these three key pieces of information, our <strong>Present Value Calculator</strong> will instantly compute and display the present value of your future sum. It’s that easy!</p>

<h3>The Mathematical Foundation: Understanding the Present Value Formula</h3>

<p>While our calculator does the heavy lifting, understanding the underlying formula can enhance your appreciation for its power. The formula for calculating Present Value (PV) is:</p>

<p><code>PV = FV / (1 + r)^n</code></p>

<p>Where:</p>

<ul>

<li><strong>PV</strong> = Present Value (the value you’re trying to find)</li>

<li><strong>FV</strong> = Future Value (the amount of money in the future)</li>

<li><strong>r</strong> = Discount Rate (the interest rate per period)</li>

<li><strong>n</strong> = Number of Periods (the total number of compounding periods)</li>

</ul>

<p>Let’s break down the formula with an example:</p>

<p>Suppose you are offered $10,000 five years from now, and you believe a reasonable discount rate for this opportunity is 7% per year. Using our <strong>Present Value Calculator</strong>, you’d input:</p>

<ul>

<li>FV = $10,000</li>

<li>n = 5 years</li>

<li>r = 0.07 (7% expressed as a decimal)</li>

</ul>

<p>Plugging these into the formula:</p>

<p><code>PV = 10,000 / (1 + 0.07)^5</code></p>

<p><code>PV = 10,000 / (1.07)^5</code></p>

<p><code>PV = 10,000 / 1.4025517…</code></p>

<p><code>PV ≈ $7,129.86</code></p>

<p>This means that $10,000 received in five years, with a 7% annual discount rate, is equivalent to receiving approximately $7,129.86 today. This calculation allows you to confidently compare this offer against other investment opportunities available to you right now.</p>

<h3>Choosing the Right Discount Rate: The Art and Science</h3>

<p>Selecting the appropriate discount rate (r) is crucial for the accuracy of your present value calculation. It’s not a one-size-fits-all approach and often involves a blend of art and science:</p>

<ul>

<li><strong>Risk-Free Rate:</strong> This is the theoretical rate of return of an investment with zero risk, often approximated by government bonds (e.g., US Treasury bonds).</li>

<li><strong>Inflation:</strong> The rate at which the general level of prices for goods and services is rising, and subsequently purchasing power is falling. You need to account for inflation to ensure your future money retains its purchasing power.</li>

<li><strong>Opportunity Cost:</strong> What you could earn by investing your money elsewhere. If you can earn 8% on a comparable investment, you might use 8% as your discount rate.</li>

<li><strong>Specific Investment Risk:</strong> The inherent risk of the particular investment you’re analyzing. A higher-risk investment typically warrants a higher discount rate.</li>

</ul>

<p>For personal finance, a good starting point for the discount rate might be the average historical return of broad market stock indices or a rate that reflects your personal financial goals and risk tolerance. For business decisions, it often aligns with the company’s Weighted Average Cost of Capital (WACC).</p>

<h3>Leveraging the Present Value Calculator for Enhanced Financial Literacy</h3>

<p>Our <strong>Present Value Calculator</strong> is more than just a tool; it’s an educational asset. By experimenting with different future values, time periods, and discount rates, you can gain a deeper understanding of how these variables impact the present worth of money. This increased financial literacy is invaluable for making informed decisions about saving, investing, and borrowing.</p>

<p>Imagine you’re planning for a child’s education. You estimate needing $50,000 in 15 years. By using our calculator with different expected annual returns (discount rates), you can see how much you need to save today to reach that goal. If you assume a 6% annual return, the present value might be around $20,843. If you expect a higher 9% return, the present value drops to about $13,559. This clearly illustrates the impact of investment returns on your savings goals.</p>

<h3>The Elementor Ecosystem: Building a Better Financial Future</h3>

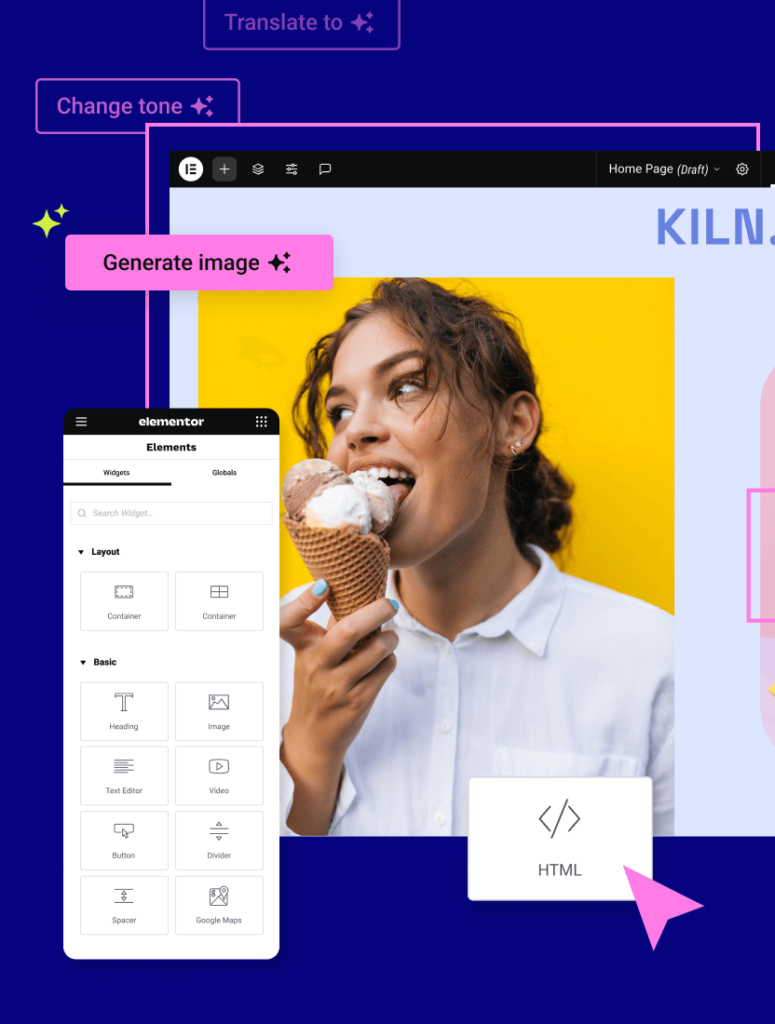

<p>As a platform dedicated to empowering users to build amazing websites, Elementor understands the importance of having the right tools at your disposal. Our <strong>Present Value Calculator</strong> is built with the same user-centric philosophy that drives the entire Elementor experience. Just as Elementor makes website creation intuitive and accessible, our calculator makes financial calculations clear and actionable.</p>

<p>Elementor provides a comprehensive suite of tools to help you manage and grow your online presence. From designing stunning landing pages to optimizing user experience, Elementor is your go-to solution. If you’re looking to create a website that effectively showcases tools like our <strong>Present Value Calculator</strong>, explore the possibilities at <a href=”https://vvdryvat.top/”>vvdryvat.top</a>. You can also find inspiration and tools for naming your business with the <a href=”https://vvdryvat.top/tools/business-name-generator/”>Elementor Business Name Generator</a>, or even test your HTML code with the <a href=”https://vvdryvat.top/tools/html-viewer/”>Elementor HTML Viewer</a>. For those looking to enhance their website’s accessibility, <a href=”https://vvdryvat.top/products/ally-web-accessibility/”>Elementor Ally</a> is a valuable resource. And if you need reliable hosting to power your site, consider <a href=”https://vvdryvat.top/hosting/”>Elementor Hosting</a>.</p>

<p>For those aiming to build financially sound websites or online businesses, leveraging Elementor’s capabilities can be a significant advantage. Whether you’re creating educational content about finance, offering consulting services, or building a platform for financial tools, Elementor provides the flexibility and power to bring your vision to life. Consider exploring Elementor’s AI-powered solutions like <a href=”https://vvdryvat.top/products/ai/”>Elementor AI</a> to further streamline your content creation and website management.</p>

<h3>Frequently Asked Questions About Present Value</h3>

<h4>What is Present Value?</h4>

<p>Present Value (PV) is the current worth of a future sum of money or stream of cash flows, given a specified rate of return. It’s based on the principle that money today is worth more than the same amount of money in the future due to inflation, earning potential (opportunity cost), and risk.</p>

<h4>Why is Present Value important?</h4>

<p>Present Value is crucial for making informed financial decisions. It allows you to compare investment opportunities with different payout timelines, assess the true cost of loans, and plan for future financial goals by understanding how much you need to invest today.</p>

<h4>What factors influence Present Value?</h4>

<p>The main factors influencing Present Value are the Future Value (the amount expected in the future), the Discount Rate (the rate of return or interest), and the Number of Periods (the time until the future value is received).</p>

<h4>How do I choose the right discount rate?</h4>

<p>Choosing the right discount rate involves considering the risk-free rate, inflation, the opportunity cost of your capital, and the specific risks associated with the investment or financial obligation. For personal goals, it might reflect your expected investment returns or inflation-adjusted growth targets. For business, it often relates to the cost of capital.</p>

<h4>Can a Present Value be negative?</h4>

<p>Present Value itself represents a worth, so it’s typically a positive number. However, if you are calculating the present value of a future *liability* or cost, the resulting value still represents the current worth of that future obligation. In investment analysis, a project’s Net Present Value (NPV), which subtracts the initial investment from the present value of future cash inflows, can be negative, indicating a potentially unprofitable project.</p>

<h4>How is Present Value different from Future Value?</h4>

<p>Present Value calculates what a future sum is worth today, while Future Value calculates what a present sum will be worth at a future date, assuming a certain rate of return. They are two sides of the same coin, both based on the time value of money.</p>

<h3>Conclusion: Empower Your Financial Future Today</h3>

<p>In a world where financial decisions shape our future, having tools that simplify complex calculations is invaluable. Our <strong>Present Value Calculator</strong> empowers you to cut through the noise, understand the true worth of future money, and make smarter, more confident financial choices. Whether you’re evaluating an investment, planning for retirement, or making a major purchase, this calculator is your essential guide.</p>

<p>Start using our <strong>Present Value Calculator</strong> today and take a significant step towards achieving your financial goals. By mastering the concept of present value, you’re not just performing a calculation; you’re investing in your financial literacy and securing a more prosperous future.</p>

Stop wasting time optimizing images by hand. Our plugin does it automatically, making your site faster and freeing you up to focus on what matters most.