Unlock Your Financial Future with the Elementor Maturity Value Calculator

In the dynamic world of personal finance, understanding the growth trajectory of your investments is paramount. Whether you’re diligently saving for retirement, planning for a major purchase, or simply curious about the power of compound interest, knowing how your money will mature is a cornerstone of smart financial planning. This is where our powerful Maturity Value Calculator comes into play, offering a user-friendly and insightful tool to project your investment’s future worth.

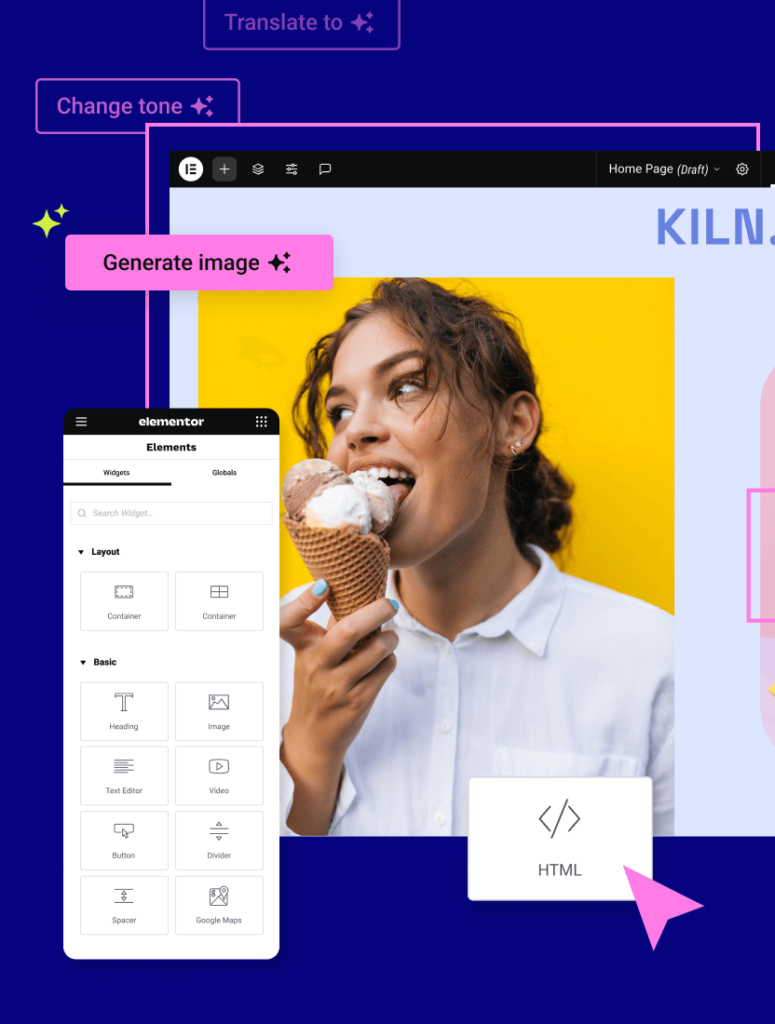

Built with the intuitive design philosophy of Elementor, this calculator is more than just a set of numbers; it’s a gateway to clarity and confidence in your financial decisions. For those of you who rely on the flexibility and ease of building your websites with Elementor, integrating and utilizing this calculator seamlessly enhances your site’s value proposition for your visitors. Imagine providing your audience with a practical, real-time tool that helps them visualize their financial goals. This article will delve deep into what the Maturity Value Calculator is, why it’s an indispensable asset for individuals and businesses alike, and how you can leverage it to your advantage.

What is a Maturity Value Calculator?

At its core, a Maturity Value Calculator is a sophisticated financial tool designed to estimate the total value of an investment at a specific future point in time. This future value, often referred to as the “maturity value,” takes into account the initial investment amount (principal), the interest rate applied, the frequency of compounding, and the duration of the investment. It essentially forecasts how your money will grow over time, factoring in the magic of compound interest.

Compound interest, often hailed as the eighth wonder of the world, is the process where your investment earns interest not only on the initial principal but also on the accumulated interest from previous periods. This exponential growth is the driving force behind long-term wealth accumulation, and our calculator helps you visualize its impact vividly.

The beauty of our Maturity Value Calculator lies in its simplicity and its ability to handle various investment scenarios. You input a few key details, and the calculator does the heavy lifting, presenting you with a clear projection of your investment’s potential future value. This eliminates the need for manual calculations, which can be tedious and prone to errors, especially when dealing with complex compounding periods.

Why is the Maturity Value Calculator Essential?

Understanding the maturity value of your investments offers a multitude of benefits, impacting everything from long-term financial planning to short-term goal setting:

- Retirement Planning: This is perhaps the most critical application. By using the calculator, individuals can project how their retirement savings will grow, helping them determine if they are on track to meet their retirement income needs. It allows for adjustments to savings rates or investment strategies based on these projections.

- Goal-Oriented Savings: Whether saving for a down payment on a house, a child’s education, or a dream vacation, the calculator provides a tangible target. Knowing the estimated maturity value can motivate you to save more consistently and make informed decisions about investment choices.

- Loan Repayment Projections: While primarily for investments, the underlying principles can be adapted to understand the total cost of loans with compound interest, although this calculator is specifically geared towards growth.

- Investment Strategy Evaluation: Comparing the projected maturity values of different investment options (e.g., different interest rates, compounding frequencies) allows for a more informed decision about where to allocate your capital for optimal growth.

- Understanding Compound Interest: For many, the abstract concept of compound interest becomes much clearer when they see its tangible results through the calculator. This understanding fosters better financial habits.

- Business Financial Planning: Businesses can use similar calculators to project the growth of invested capital, understand the potential returns on new projects, or plan for future capital needs.

For website owners, particularly those using Elementor to build their sites, offering tools like this calculator can significantly boost user engagement and provide real value. It positions your website as a resource, encouraging repeat visits and building a loyal audience. Imagine the impact on a financial advisory website, a personal finance blog, or even a platform for small businesses. It’s a practical application that directly addresses user needs.

How Does the Maturity Value Calculator Work? (In 3 Simple Steps)

Our Maturity Value Calculator is designed for ease of use, making complex financial projections accessible to everyone. Here’s a breakdown of how it works:

- Input Your Investment Details: The first step involves providing the essential parameters of your investment. This typically includes:

- Principal Amount: The initial sum of money you are investing.

- Annual Interest Rate: The percentage of interest your investment is expected to earn per year.

- Investment Period (in years): The length of time you plan to keep your money invested.

- Compounding Frequency: This is a crucial factor. It indicates how often the interest is calculated and added to the principal. Common options include annually, semi-annually, quarterly, monthly, or even daily. The more frequent the compounding, the greater the potential for accelerated growth due to the power of earning interest on interest more often.

- Initiate the Calculation: Once you have entered all the necessary information accurately, simply click the “Calculate” button. The calculator then uses a well-established financial formula to perform the projection. The underlying formula for maturity value with compound interest is:M = P (1 + r/n)^(nt)

Where:

- M = the future value of the investment/loan, including interest

- P = the principal investment amount (the initial deposit or loan amount)

- r = the annual interest rate (as a decimal)

- n = the number of times that interest is compounded per year

- t = the number of years the money is invested or borrowed for

Our calculator automates this process, ensuring accuracy and saving you the trouble of manual computation.

- View Your Projected Maturity Value: The calculator will instantly display your projected maturity value. This figure represents the estimated total amount you can expect to have at the end of your investment period, including your initial principal and all the accumulated compound interest. You might also see a breakdown showing the total interest earned, further illustrating the growth potential. This clear, concise result empowers you to make informed decisions about your financial path.

Leveraging the Maturity Value Calculator on Your Elementor Website

For users of Elementor, integrating and promoting our Maturity Value Calculator on your website is straightforward and highly beneficial. It’s a powerful tool that can attract visitors, increase engagement, and provide genuine utility.

Imagine a scenario where you run a personal finance blog built with Elementor. By embedding this calculator, you offer your readers a hands-on experience to explore their savings goals. This not only enhances the perceived value of your content but also keeps visitors on your site longer. They can experiment with different scenarios – changing interest rates, investment durations, or compounding frequencies – all within your website’s interface.

Furthermore, you can use this calculator as a lead generation tool. Encourage visitors to enter their email address to receive a PDF report of their projected maturity value. This is a highly effective way to build your email list and nurture potential leads.

Consider the broader implications for your website’s functionality and user experience. By offering interactive tools, you differentiate yourself from static content sites. It’s about providing a dynamic and engaging experience that keeps users coming back. If you’re looking to create a more robust and feature-rich website, exploring other Elementor tools can further enhance your capabilities. For instance, the Elementor Business Name Generator can help you brainstorm creative names for your ventures, while the Elementor HTML Viewer is invaluable for web development tasks.

For those focused on accessibility, ensuring your website, including integrated tools, meets high standards is crucial. Elementor Ally Web Accessibility can assist in making your site inclusive for all users. And when it comes to hosting, choosing a reliable provider is key to ensuring your website and its tools are always available and performant. Elementor Hosting offers a seamless solution for this.

Tips for Maximizing the Use of Your Maturity Value Calculator

To get the most out of the Maturity Value Calculator, consider these practical tips:

- Be Realistic with Assumptions: While the calculator provides projections, remember that interest rates can fluctuate, and investment performance is not guaranteed. Use conservative estimates for interest rates to get a more realistic outlook.

- Experiment with Scenarios: Don’t just run one calculation. Play around with different inputs. What happens if you increase your monthly savings? What if you invest for an extra five years? This exploration can be highly motivating.

- Understand Compounding Frequency: Pay close attention to how compounding frequency impacts the final maturity value. Even small differences can lead to significant growth over the long term.

- Integrate with Other Financial Tools: If you have other financial calculators or resources on your website (e.g., inflation calculators, retirement planning worksheets), link them to the Maturity Value Calculator to provide a more comprehensive financial planning experience.

- Educate Your Audience: Accompany the calculator with clear explanations of the terms used (principal, interest rate, compounding). This educates your users and builds trust.

- Call to Action: Encourage users to take the next step after using the calculator. This could be to review your recommended investment products, contact a financial advisor, or start a savings plan.

The Power of Visualization in Financial Planning

The human brain often responds better to visual information. A number on a screen can be abstract, but seeing that number grow over time, especially with compound interest, can be incredibly powerful. Our Maturity Value Calculator provides this vital visualization. It transforms abstract financial concepts into tangible projections that resonate with individuals and motivate them to take action.

For website owners, this visual element is a significant advantage. It makes your content more engaging and your tools more impactful. When users can see the potential outcome of their financial efforts, they are more likely to stay engaged with your content and revisit your site for further guidance.

Consider the variety of content you can create around the calculator. Blog posts explaining compound interest with examples from the calculator, infographics showcasing growth over different time horizons, or social media posts highlighting impressive projected returns can all drive traffic and engagement to your website.

Future-Proofing Your Financial Strategy

In today’s ever-evolving economic landscape, having a clear understanding of your financial trajectory is crucial for future-proofing your strategy. The Maturity Value Calculator serves as a compass, helping you navigate towards your financial destinations with greater certainty. By regularly using and understanding the results from this tool, you can make proactive adjustments to your investment plans, ensuring you remain on course to achieve your long-term objectives.

Whether you’re planning for a distant retirement or a nearer-term goal, the ability to project and visualize your financial growth is an invaluable asset. It empowers you to make informed decisions, stay motivated, and ultimately, build a more secure financial future.

As a user of Elementor, you have the power to create engaging and functional websites that serve your audience’s needs. By incorporating tools like the Maturity Value Calculator, you elevate your website’s utility and establish yourself as a valuable resource in the digital space. Don’t forget to explore the full suite of Elementor products, including their cutting-edge AI features, to further enhance your website’s capabilities and provide an even richer experience for your visitors.

Remember, financial planning is a continuous journey. Tools like the Maturity Value Calculator are your companions on this journey, providing the insights and clarity needed to make smart, informed decisions every step of the way. Take advantage of this powerful resource and start projecting your financial future today!