Unlock Your Business’s Financial Potential with the Ultimate Markup and Profit Margin Calculator

In the competitive landscape of modern business, understanding your pricing strategy isn’t just beneficial; it’s absolutely critical for survival and growth. Are your products and services priced to maximize profitability while remaining attractive to your target market? This is where a robust Markup and Profit Margin Calculator becomes an indispensable tool. Whether you’re a seasoned entrepreneur with a complex product catalog or a budding freelancer just starting out, knowing precisely how your pricing translates into actual profit is the bedrock of a sustainable and thriving business.

This article will delve deep into the world of pricing, exploring the intricacies of markup and profit margin, why they matter, and how to leverage our powerful Markup and Profit Margin Calculator to achieve your financial goals. We’ll demystify the concepts, provide practical examples, and guide you through using our intuitive tool to transform your pricing approach.

Why Understanding Markup and Profit Margin is Non-Negotiable

Before we dive into the mechanics of our calculator, let’s establish a firm understanding of what markup and profit margin actually are, and why they are so vital to your business’s financial health.

What is Markup?

In its simplest form, markup is the amount added to the cost of a product or service to determine its selling price. It’s the “extra” you charge on top of what it costs you to acquire or produce something. Markup is typically expressed as a percentage of the cost price.

Formula: Markup Amount = Selling Price – Cost Price

Formula: Markup Percentage = (Markup Amount / Cost Price) * 100

For instance, if you buy a widget for $10 and sell it for $15, your markup amount is $5, and your markup percentage is 50% ($5 / $10 * 100).

Markup is a crucial element in setting your initial selling price. It ensures that you cover your direct costs and contribute towards your overheads and, ultimately, your profit. However, it’s important to remember that markup alone doesn’t tell the whole story of your profitability.

What is Profit Margin?

Profit margin, on the other hand, is the percentage of revenue that remains as profit after all expenses, including direct costs, overheads, and operating expenses, have been deducted. It’s a more comprehensive measure of profitability, reflecting how efficiently your business converts sales into actual profit.

There are different types of profit margins, but the most commonly referred to are Gross Profit Margin and Net Profit Margin.

- Gross Profit Margin: This is calculated by deducting the Cost of Goods Sold (COGS) from your revenue and dividing the result by your revenue. It shows how effectively you manage your direct costs associated with producing or acquiring your products.

- Net Profit Margin: This is the bottom line. It’s calculated by deducting all expenses, including COGS, operating expenses, interest, and taxes, from your total revenue. This metric provides a clear picture of your overall business profitability.

Formula: Gross Profit Margin = ((Revenue – Cost of Goods Sold) / Revenue) * 100

Formula: Net Profit Margin = ((Total Revenue – Total Expenses) / Total Revenue) * 100

For example, if your widget selling for $15 had a Cost of Goods Sold of $10, your gross profit is $5. Your gross profit margin would be ($5 / $15) * 100 = 33.33%. This means that for every dollar of sales, you retain 33.33 cents after covering the direct cost of the widget. The net profit margin would consider all other business expenses.

The Crucial Distinction and Why Both Matter

The key difference lies in what they measure. Markup is about the pricing strategy applied to a single product or service, focusing on the cost to sell price conversion. Profit margin is about the overall financial performance of your business, looking at how much of your revenue translates into profit after *all* costs are accounted for.

Ignoring either can lead to significant financial pitfalls:

- Too low a markup: You might be underpricing your products, leading to insufficient revenue to cover all your business expenses, even if your sales volume is high. This can result in low or negative profit margins.

- Too high a markup: While it might seem like more profit per item, an excessively high markup can make your products uncompetitive, driving customers to your rivals. This can lead to low sales volume and, ultimately, lower overall profits.

- Ignoring profit margin: You might have a healthy markup, but if your operating expenses are too high, your actual profit margin can be razor-thin or even negative. This means your business isn’t as financially healthy as your product pricing might suggest.

A balanced approach, where you understand and strategically manage both your markup and your profit margins, is essential for long-term business success. This is precisely why our Markup and Profit Margin Calculator is designed to be your ultimate financial ally.

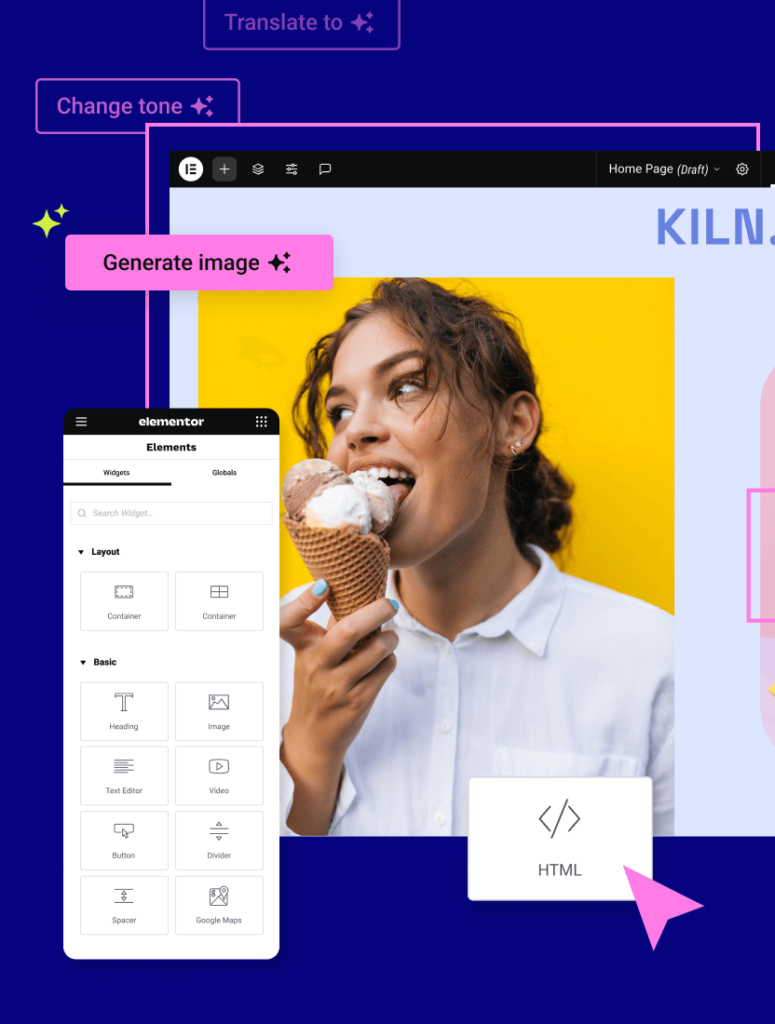

Introducing the Elementor Markup and Profit Margin Calculator: Your Financial Navigator

We understand that navigating the complexities of pricing can be daunting. That’s why we’ve developed a user-friendly and powerful Markup and Profit Margin Calculator that empowers you to make informed pricing decisions with confidence. Built with the same dedication to simplicity and effectiveness found across all Elementor tools, our calculator is designed to be your go-to resource for financial clarity.

Whether you’re a small business owner, a freelancer, or part of a larger enterprise, this tool can help you:

- Determine the optimal selling price based on your costs and desired profit margin.

- Calculate your current profit margin to understand your business’s financial health.

- Analyze different pricing scenarios to identify the most profitable strategies.

- Ensure your prices are competitive and appealing to your target audience.

- Streamline your financial planning and forecasting.

How Our Markup and Profit Margin Calculator Works: A Simple 3-Step Process

We believe that powerful tools should be accessible and easy to use. Our Markup and Profit Margin Calculator follows a straightforward, intuitive process:

Step 1: Input Your Costs

The foundation of any pricing strategy is understanding your costs. In this first step, you’ll input the direct costs associated with your product or service. This can include:

- Cost of Goods Sold (COGS): The direct costs attributable to the production of the goods sold by your company. This includes the cost of raw materials and direct labor.

- Operating Expenses (Optional, for comprehensive margin calculation): While our primary focus here is on per-unit costing for markup and gross profit, for a more holistic view of net profit margin, you might consider allocating a portion of your overheads (rent, utilities, marketing, salaries, etc.) per unit. However, for the basic markup and gross profit calculation, the COGS is the primary input.

Simply enter the relevant cost figures into the designated fields. The more accurate your cost input, the more accurate your pricing and profit calculations will be.

Step 2: Define Your Desired Outcome

This is where you tell the calculator what you want to achieve. You have two primary options:

- Calculate Selling Price based on Markup Percentage: If you know the markup percentage you want to apply to your cost, input that value. For example, if you want a 50% markup on a $10 item, you’d enter 50%.

- Calculate Selling Price based on Desired Profit Margin: If you have a target profit margin in mind (e.g., you want 20% of your selling price to be profit), you can input this percentage. This is a more advanced and often more effective way to price, as it directly links your selling price to your overall profitability.

Alternatively, if you already have a selling price and want to understand your current profitability, you can input the selling price and then choose to calculate the existing markup or profit margin.

Step 3: Get Your Instant Results

Once you’ve entered your costs and defined your desired outcome, simply click the “Calculate” button. In an instant, our Markup and Profit Margin Calculator will provide you with:

- Calculated Selling Price: The recommended price for your product or service based on your inputs.

- Calculated Markup Amount: The dollar value of the markup added to your cost.

- Calculated Markup Percentage: The markup expressed as a percentage of your cost.

- Calculated Gross Profit: The profit before deducting operating expenses.

- Calculated Gross Profit Margin: The gross profit as a percentage of the selling price.

These results are presented clearly and concisely, allowing you to immediately assess the financial implications of your pricing decisions. You can then tweak your inputs and recalculate to explore different scenarios, helping you find the sweet spot between profitability and market competitiveness.

Practical Applications and Use Cases

Our Markup and Profit Margin Calculator is a versatile tool applicable across a wide range of business scenarios:

For Product-Based Businesses (e-commerce, retail, manufacturing):

- Sourcing New Products: When evaluating potential new products to stock, input the landed cost (including shipping, import duties, etc.) and use the calculator to determine a selling price that ensures a healthy profit margin.

- Pricing New Product Lines: Launching a new range? Use the calculator to set prices that align with your overall business profitability goals.

- Discounting and Promotions: Before offering a discount, use the calculator to see how it impacts your profit margin. This helps you determine the maximum discount you can offer without eroding your profitability.

- Wholesale Pricing: If you sell to retailers, our calculator can help you set wholesale prices that are attractive to them while still providing a good margin for your business.

For Service-Based Businesses (freelancers, agencies, consultants):

- Setting Hourly Rates: If you bill by the hour, use the calculator to determine a rate that covers your costs (including your time, software, overheads) and delivers your desired profit margin.

- Project-Based Pricing: For fixed-price projects, estimate your costs (time, materials, subcontractors) and use the calculator to set a project fee that ensures profitability.

- Package Deals: When bundling services, the calculator can help you price these packages competitively while maintaining healthy margins.

For Online Businesses and Website Owners:

If you build and manage websites, perhaps using a powerful platform like Elementor, understanding the profitability of your services is crucial. Our calculator is invaluable for:

- Pricing Web Design Packages: Determine the cost of your time, design assets, and any third-party tools, then set package prices that reflect your value and desired profit.

- Setting Retainer Fees: Calculate recurring revenue from maintenance or SEO services with the calculator to ensure these ongoing services are profitable.

- Pricing Digital Products: If you sell themes, plugins, or online courses, the calculator helps you price them effectively.

For business owners who want to elevate their online presence and marketing efforts, exploring other helpful tools can also be beneficial. For instance, if you’re struggling to find the perfect name for your business, the Elementor Business Name Generator can spark creativity. Similarly, understanding the structure of your web pages is made easier with the Elementor HTML Viewer. For those looking to leverage the latest technology, exploring Elementor AI can revolutionize content creation, while ensuring your site is accessible to everyone can be achieved with Elementor Ally Web Accessibility. And for a seamless website experience, consider Elementor Hosting.

Advanced Considerations and Best Practices

While our calculator provides a robust foundation, here are some advanced tips to optimize your pricing strategy:

1. Know Your Competitors

While you should never blindly copy your competitors, understanding their pricing can provide valuable market context. Use our calculator to ensure your prices are competitive while still achieving your profit goals.

2. Understand Your Value Proposition

Price should reflect the value you provide to your customers. If you offer superior quality, exceptional customer service, or unique features, you may be able to command higher prices and achieve higher profit margins.

3. Segment Your Pricing

Consider offering different pricing tiers or packages to cater to various customer segments. A basic package might have a lower margin but attract more customers, while a premium package could offer higher margins to clients who value additional features or support.

4. Factor in Perceived Value

Sometimes, a slightly higher price can actually increase the perceived value of a product or service. Customers often associate higher prices with higher quality.

5. Review and Adjust Regularly

Your costs, market conditions, and business goals will evolve. Make it a habit to review your pricing strategy and use the Markup and Profit Margin Calculator regularly to ensure your prices remain optimal.

6. Don’t Forget About Taxes and Fees

When calculating your final selling price, always account for any sales taxes, payment processing fees, or platform commissions that might apply. These can eat into your profit if not factored in.

7. Consider Psychological Pricing

Techniques like pricing items at $9.99 instead of $10.00 can have a psychological impact on customers. While our calculator provides the core figures, you can apply these psychological tactics to the resulting price.

The Power of Informed Pricing

In conclusion, a clear understanding of your markup and profit margin is not just about numbers; it’s about building a sustainable, profitable, and resilient business. Our Markup and Profit Margin Calculator is designed to empower you with the insights needed to make these critical decisions with confidence.

By accurately calculating your costs, defining your desired outcomes, and leveraging the instantaneous results our tool provides, you can set prices that drive revenue, ensure healthy profit margins, and position your business for long-term success. Don’t leave your profitability to chance – use the Markup and Profit Margin Calculator today and take control of your financial future.