Unlock Your Financial Future with the Elementor Compound Growth Calculator

Are you looking to understand the true power of your investments? Do you dream of seeing your money grow exponentially over time? If so, you’ve landed in the right place. At Elementor, we’re committed to providing you with the tools and resources you need to build a successful online presence and manage your finances effectively. That’s why we’re thrilled to introduce our state-of-the-art Compound Growth Calculator.

This intuitive and powerful tool is designed to demystify the concept of compound growth, often hailed as the “eighth wonder of the world.” Whether you’re a seasoned investor or just starting your financial journey, understanding how compound growth works is crucial for achieving your long-term financial goals. Our calculator takes the guesswork out of it, allowing you to visualize the potential returns of your investments with just a few simple inputs.

Imagine your money not just earning interest, but earning interest on your interest. That’s the magic of compounding. It’s a snowball effect for your wealth, where small, consistent contributions can lead to substantial financial growth over decades. But how does it actually work? Let’s break it down.

How It Works: The Simple Magic of Compounding

Our Compound Growth Calculator makes understanding this powerful financial concept incredibly easy. Here’s a breakdown in three simple steps:

- Input Your Initial Investment: Start by entering the initial amount of money you plan to invest. This is your starting capital, the seed from which your wealth will grow.

- Add Your Regular Contributions (Optional but Recommended): Decide if you’ll be adding to your investment regularly – monthly, annually, or at any frequency you choose. Consistent contributions significantly accelerate compound growth.

- Set Your Growth Rate and Time Horizon: Input the expected annual rate of return for your investment and how long you plan to keep your money invested. The longer your money compounds, the more significant the growth becomes.

Once you’ve entered these details, our calculator will instantly show you the projected future value of your investment, illustrating the incredible power of compounding. You can then experiment with different scenarios, adjusting your inputs to see how changes in your investment amount, contribution frequency, growth rate, or investment duration can impact your final outcome.

Why is Compound Growth So Important?

The principle of compound growth is fundamental to building long-term wealth. It’s the reason why starting early with your investments is often so advantageous. The longer your money has to compound, the more dramatic the results. This is especially true in the world of investing, where even modest returns, when compounded over many years, can lead to astonishing wealth accumulation.

Consider the difference between simple interest and compound interest. With simple interest, you earn interest only on your principal amount. With compound interest, you earn interest on your principal AND on the accumulated interest from previous periods. This “interest on interest” is the engine that drives exponential growth.

For example, if you invest $1,000 at a 5% annual interest rate:

- Simple Interest: After 10 years, you’d earn $50 per year ($1,000 x 5%), totaling $500 in interest. Your total would be $1,500.

- Compound Interest: After 10 years, your investment would have grown to approximately $1,628.89. The difference of $128.89 might seem small initially, but over longer periods and with larger sums, this difference becomes astronomical.

Our Compound Growth Calculator empowers you to see these differences firsthand. You can input your specific investment goals and see the projected outcomes, helping you make informed decisions about your financial strategy.

Features of the Elementor Compound Growth Calculator

We’ve designed our calculator with user-friendliness and comprehensive functionality in mind. Here are some of the key features you can expect:

- Intuitive Interface: Easy-to-understand fields and clear output make it simple for anyone to use, regardless of their financial expertise.

- Adjustable Variables: Control and experiment with your initial investment, regular contributions, interest rate, and investment duration.

- Clear Visualizations: While our calculator provides numerical outputs, the underlying principle is visual – see how your money can grow over time.

- Scenario Planning: Test different investment strategies and see how they might play out. This is invaluable for setting realistic expectations and adjusting your approach.

- Mobile Responsiveness: Access and use the calculator seamlessly on any device, from your desktop computer to your smartphone, wherever you are.

Who Can Benefit from Using This Calculator?

The applications of the Compound Growth Calculator are vast, touching on many aspects of personal finance and investment planning. Here are just a few examples of who can benefit:

1. Young Investors and Savers

The earlier you start investing, the more time your money has to compound. For young individuals just beginning their careers, understanding how even small, consistent investments can grow over 30, 40, or even 50 years is incredibly motivating. This calculator can help them visualize the long-term rewards of saving diligently and investing wisely early on.

2. Retirement Planning

Retirement might seem far off for some, but planning for it is essential. Our calculator allows you to project how your retirement savings – whether in a 401(k), IRA, or other investment accounts – could grow over decades. This helps you determine if you’re on track to meet your retirement income goals and make necessary adjustments to your savings rate or investment strategy.

3. Long-Term Investment Goals

Beyond retirement, people have other significant long-term financial goals, such as saving for a down payment on a house, funding a child’s education, or building a substantial investment portfolio. The compound growth calculator can help you estimate how long it will take to reach these goals based on different savings rates and investment returns.

4. Understanding the Impact of Fees and Inflation

While our primary calculator focuses on growth, understanding the impact of fees and inflation is also critical. High investment fees can significantly eat into your returns, and inflation erodes the purchasing power of your money. While not directly part of this calculator, knowing the power of compounding highlights the importance of minimizing costs and understanding real returns (returns after inflation).

5. Educational Tool for Financial Literacy

For educators, parents, and financial advisors, this calculator serves as an excellent tool for teaching the principles of compound growth and investing. Demonstrating the concept visually makes it more engaging and understandable for learners of all ages.

6. Evaluating Different Investment Options

You can use the calculator to compare the potential outcomes of different investment vehicles or strategies. For instance, you could see the difference in projected growth between an investment with a 6% annual return and one with an 8% annual return, helping you make more informed choices.

Leveraging Elementor for Your Financial Journey

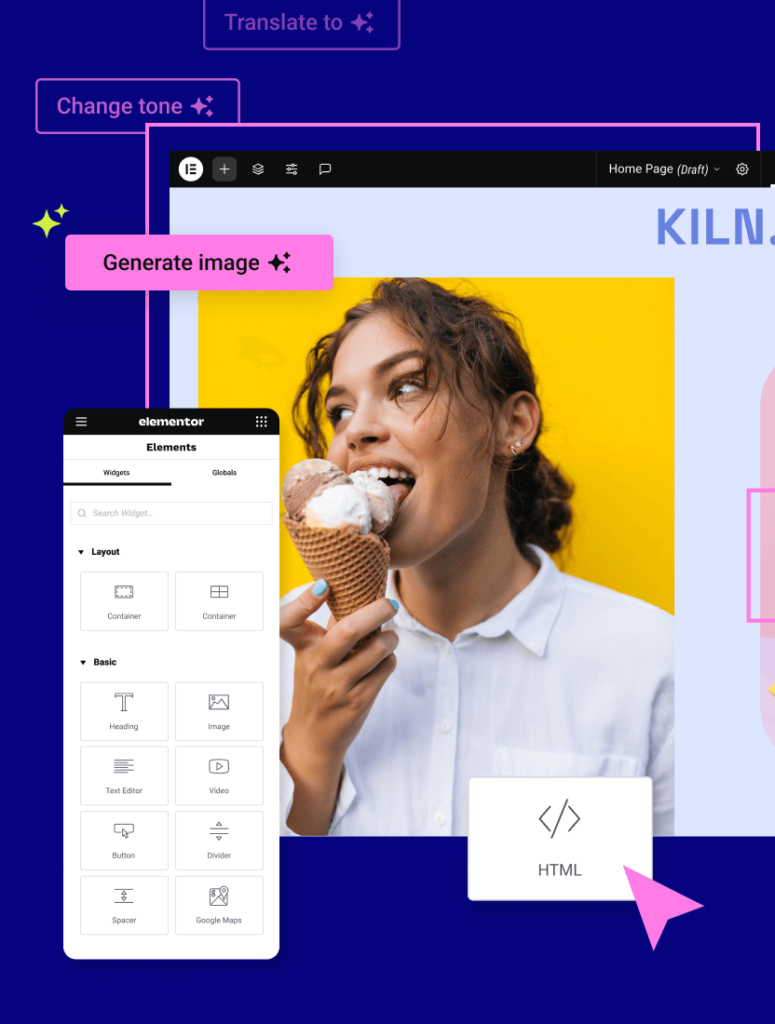

At Elementor, we believe in empowering individuals and businesses to thrive. While our Compound Growth Calculator helps you with financial planning, the Elementor website builder is your ultimate tool for creating a stunning and functional website to showcase your expertise, products, or services. Whether you’re a financial advisor, a blogger sharing investment tips, or an entrepreneur looking to attract clients, Elementor provides a seamless and intuitive platform to bring your vision to life.

With Elementor, you can easily design professional-looking pages, customize every element, and ensure your website is responsive and accessible to all users. Explore the power of drag-and-drop design and unlock your website’s full potential. You might even find our Business Name Generator helpful for branding your financial services or blog.

For those looking to enhance their web development workflow, our HTML Viewer can be a handy utility. And if you’re focused on making your digital presence inclusive, Elementor Ally Web Accessibility ensures your site is usable by everyone. Consider Elementor Hosting Elementor Hosting for a fully optimized and integrated website experience.

Furthermore, for those seeking to streamline their content creation process, Elementor’s AI-powered features Elementor AI can assist in generating text, headlines, and even code snippets, further accelerating your web development and content strategy.

The Psychology of Compound Growth

Beyond the numbers, compound growth has a significant psychological impact. It fosters patience, discipline, and a long-term perspective. In a world often focused on instant gratification, the concept of waiting for your investments to grow through compounding can be challenging. However, by visualizing the potential outcomes using our calculator, you can reinforce the benefits of delayed gratification and the rewards of consistent effort.

The “hockey stick” graph, often used to illustrate compound growth, is a powerful visual aid. It starts flat or grows slowly, then at some point, it begins to curve sharply upwards. This curve represents the accelerating nature of compounding. Understanding this visual can help you stay motivated during the early stages of investing when the growth might seem negligible.

It’s also important to manage expectations. While compound growth is powerful, it’s not a get-rich-quick scheme. It requires time, discipline, and often, a degree of risk tolerance depending on the investment vehicles chosen. Our calculator provides projections, but actual returns can vary based on market conditions and individual investment choices.

Tips for Maximizing Compound Growth

To make the most of the power of compounding, consider these actionable tips:

- Start Early: The sooner you begin, the more time your money has to grow. Even small amounts invested early can outperform larger amounts invested later.

- Invest Consistently: Regular contributions, even if modest, can significantly boost your compounded returns. This is often referred to as dollar-cost averaging.

- Choose Wisely: Select investments that have the potential for good returns over the long term. Research and understand the risks involved.

- Reinvest Your Earnings: Ensure that any dividends or interest earned are reinvested back into your investment. This is the core mechanism of compounding.

- Minimize Fees: High investment fees can eat into your returns. Opt for low-cost investment options like index funds or ETFs where possible.

- Be Patient: Compound growth takes time. Resist the urge to make impulsive decisions based on short-term market fluctuations.

- Increase Your Contributions: As your income grows, try to increase the amount you invest. This will further accelerate your compounding journey.

Conclusion: Your Path to Financial Growth Starts Here

The Elementor Compound Growth Calculator is more than just a tool; it’s a gateway to understanding and achieving your financial aspirations. By demystifying compound growth, it empowers you to make smarter financial decisions, plan for the future with confidence, and watch your wealth grow over time.

Whether you’re saving for a comfortable retirement, planning for a child’s education, or simply aiming to build a more secure financial future, the principles of compound growth are your allies. Use our calculator to explore different scenarios, set realistic goals, and stay motivated on your journey. Remember, the most powerful tool you have is knowledge, and our calculator is here to provide you with precisely that.

Start exploring your financial potential today with the Elementor Compound Growth Calculator. It’s your first step towards a brighter, more prosperous future. Don’t just dream about your financial goals; start planning and building them into reality with the power of compounding and the innovative tools from Elementor.