Market Capitalization Calculator

Market Capitalization

$0.00

Copied to clipboard!

Market Capitalization

In the dynamic world of investing, understanding the true value and scale of a company is paramount. For both seasoned investors and those just beginning their financial journey, the concept of Market Capitalization (often shortened to Market Cap) serves as a foundational metric. It’s a simple yet powerful indicator that helps categorize companies by size, assess their risk profile, and gauge their overall influence within their respective industries. But how do you quickly and accurately calculate this vital figure? That’s where our Market Capitalization Calculator comes in – a user-friendly, efficient tool designed to provide you with instant insights.

Before we delve into how our calculator works, let’s establish a clear understanding of what Market Capitalization represents. In essence, Market Capitalization is the total dollar market value of a company’s outstanding shares of stock. It’s calculated by multiplying the current market price of a single share by the total number of outstanding shares. This figure provides a snapshot of how much the market believes the company is worth at any given moment.

Think of it like this: if a company has 1 million shares outstanding, and each share is trading at $50, its market capitalization is $50 million (1 million shares * $50/share). This number isn’t static; it fluctuates constantly with the stock price. A rising stock price increases market cap, while a falling stock price decreases it.

The significance of market capitalization extends far beyond a simple calculation. It plays a crucial role in several aspects of investment strategy:

Our Market Capitalization Calculator is designed for speed and simplicity, allowing you to get the information you need without any complex financial jargon or tedious calculations. Here’s how it works:

It’s that easy! You’ll have a precise market capitalization figure in seconds, empowering you to make more informed investment decisions.

While our Market Capitalization Calculator provides the raw number, it’s important to remember that the factors influencing this number are complex and varied. The market price of a stock is influenced by a multitude of elements, including:

Understanding these influencing factors can help you interpret the market cap figure generated by our calculator in a more nuanced way.

Our Market Capitalization Calculator is more than just a numerical tool; it’s a strategic asset for any investor. Here are some practical ways to leverage it:

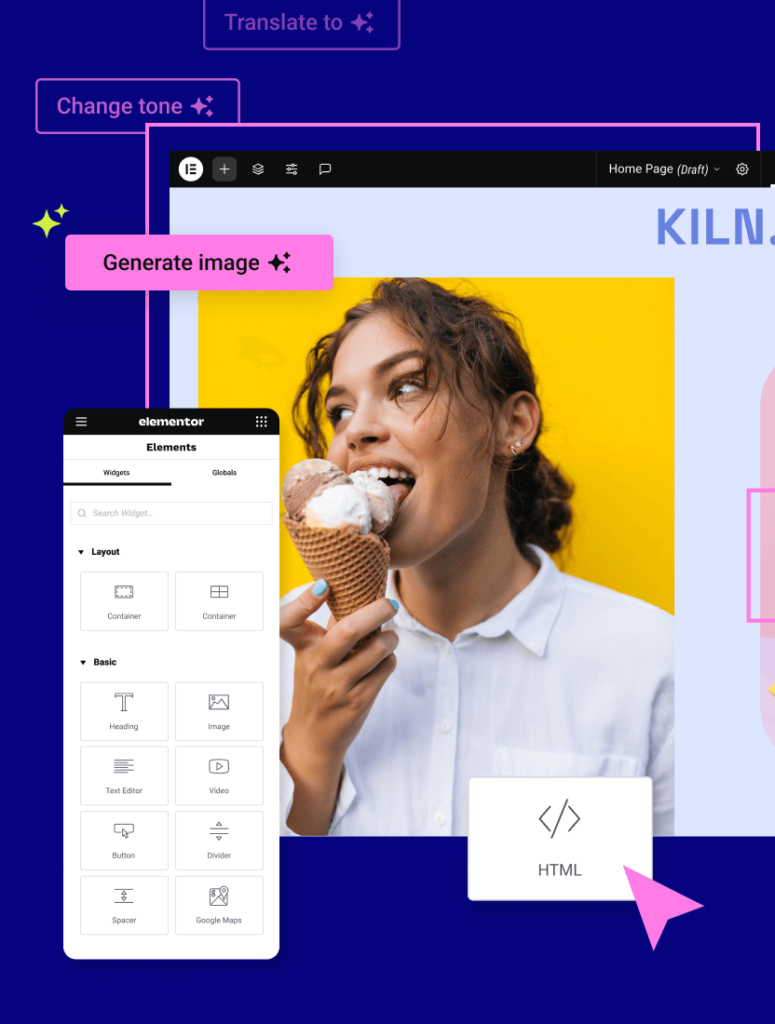

Creating valuable tools like our Market Capitalization Calculator is made seamless and efficient with the power of Elementor. As a leading WordPress website builder, Elementor empowers users of all skill levels to design and launch stunning, functional websites without needing to write a single line of code. Its intuitive drag-and-drop interface, vast library of widgets, and flexible design options mean you can create sophisticated tools, engaging landing pages, and professional-looking websites with ease.

Whether you’re building a financial resource hub, a small business website, or an e-commerce store, Elementor provides the flexibility and power you need. You can even explore Elementor’s other innovative tools, such as the Elementor AI for content creation assistance, or the Ally Web Accessibility tool to ensure your site is inclusive for all users. For those interested in website performance, Elementor Hosting offers a streamlined solution. And if you’re curious about code structure, the HTML Viewer is a handy resource.

Q: Is market capitalization the same as company valuation? A: While market capitalization is a key component of company valuation, it’s not the sole determinant. Valuation can also consider factors like debt, cash flow, and future growth prospects. Market cap is essentially the market’s current assessment of a company’s equity value.

Q: How often does market capitalization change? A: Market capitalization changes constantly as the stock price fluctuates throughout the trading day. The number of outstanding shares typically changes less frequently, usually only when a company issues new shares or repurchases existing ones.

Q: What is the difference between market cap and enterprise value (EV)? A: Market cap represents the value of a company’s equity, while enterprise value (EV) represents the total value of a company, including both its equity and debt, minus any cash and cash equivalents. EV is often considered a more comprehensive measure of a company’s total worth.

Q: Can a company have a negative market cap? A: No, a company cannot have a negative market cap. Since the share price cannot be negative, and the number of outstanding shares is always a positive number, the market capitalization will always be zero or a positive value.

Q: How do I find the number of outstanding shares for a company? A: You can typically find the number of outstanding shares in a company’s latest quarterly (10-Q) or annual (10-K) financial filings with the relevant regulatory body (e.g., the SEC in the US). Reputable financial news and data websites also usually list this information.

In conclusion, understanding and utilizing market capitalization is a fundamental skill for any investor. Our Market Capitalization Calculator provides a quick, accurate, and accessible way to determine this crucial metric, empowering you to make more informed decisions, better assess risk, and strategically position your investments. Coupled with the powerful website-building capabilities of Elementor, you can create a platform that not only offers valuable tools but also presents them in a professional and user-friendly manner.

Whether you’re a seasoned trader or just starting out, remember that knowledge is power. By leveraging tools like our Market Capitalization Calculator, you can navigate the complexities of the stock market with greater confidence and clarity.

Stop wasting time optimizing images by hand. Our plugin does it automatically, making your site faster and freeing you up to focus on what matters most.