Unlock the Power of Your Earnings: The Ultimate PayPal Fee Calculator for Elementor Websites

In the dynamic world of online business, efficiency and transparency are paramount. For those who leverage the power of PayPal to manage their transactions, understanding the associated fees is not just a matter of financial prudence; it’s a cornerstone of profitable growth. Whether you’re a seasoned e-commerce entrepreneur, a freelance artist showcasing your work, or a small business owner accepting payments, the intricacies of PayPal fees can often feel like a labyrinth. This is where our revolutionary PayPal Fee Calculator comes into play, designed specifically for users of the incredibly versatile Elementor page builder.

Navigating the often-complex fee structures of payment processors can be a time-consuming and error-prone task. But what if you could instantly and accurately calculate these charges with just a few clicks, directly on your own website? Our PayPal Fee Calculator tool empowers you to do just that, providing clarity and control over your financial outflow. Built with the user in mind and seamlessly integrated into the Elementor ecosystem, this calculator is more than just a utility; it’s a strategic asset for anyone serious about maximizing their online revenue.

This comprehensive article will delve deep into the importance of understanding PayPal fees, explore the common types of fees you might encounter, and demonstrate how our PayPal Fee Calculator can be your indispensable ally. We’ll cover everything from standard transaction fees to international charges, chargeback fees, and more, all presented in a way that is accessible and actionable. You’ll discover how this tool can streamline your financial planning, improve your pricing strategies, and ultimately contribute to the sustained success of your online ventures.

Why Understanding PayPal Fees is Crucial for Your Business

PayPal has become a ubiquitous name in online payments, trusted by millions of businesses and individuals worldwide. Its ease of use, global reach, and robust security features make it an attractive option for processing transactions. However, like all payment processors, PayPal charges fees for its services. These fees, while necessary for PayPal to operate and innovate, can significantly impact your profit margins if not properly accounted for.

Imagine a scenario where you’ve just made a significant sale, but you haven’t factored in the PayPal fees. The actual amount that hits your account might be less than you anticipated, potentially throwing off your budget or affecting your ability to reinvest in your business. This is where a precise PayPal Fee Calculator becomes invaluable. It provides real-time, accurate calculations, allowing you to:

- Accurate Pricing: Ensure your product or service prices adequately cover PayPal’s fees, protecting your profitability.

- Financial Planning: Forecast your earnings and expenses with greater accuracy, aiding in sound financial decision-making.

- Customer Transparency: If you choose to pass on certain fees (though not always recommended), you can do so with clear, pre-calculated figures.

- Budget Management: Allocate funds more effectively by knowing exactly how much will be deducted for payment processing.

- Business Growth: By minimizing unexpected costs, you free up capital that can be reinvested in marketing, product development, or scaling your operations.

In essence, a PayPal Fee Calculator acts as a financial advisor in your pocket, ensuring that every transaction contributes positively to your bottom line.

Common PayPal Fees Explained

PayPal’s fee structure can seem a bit daunting at first glance, as it varies depending on the type of transaction, your location, and whether you’re sending or receiving money. Here’s a breakdown of some of the most common fees you might encounter:

1. Standard Transaction Fees (Receiving Payments for Goods and Services)

This is the most common fee for businesses. When you sell a product or service and receive payment through PayPal, a percentage of the transaction amount plus a fixed fee is typically charged. The exact percentage and fixed fee can vary by country.

Example: If PayPal charges 2.9% + $0.30 per transaction, and you receive a payment of $100, the fee would be ($100 * 0.029) + $0.30 = $2.90 + $0.30 = $3.20. Your net earning would be $96.80.

2. International Transaction Fees

If you or your customer is in a different country, PayPal often charges an additional fee for cross-border transactions. This can be a percentage of the transaction amount, and it’s usually on top of the standard transaction fee.

Example: In addition to the standard fee, there might be an extra 1.5% international fee. If the standard fee was $3.20 on a $100 transaction, an additional $1.50 (1.5% of $100) would be added, bringing the total fee to $4.70.

3. Currency Conversion Fees

When a transaction involves a currency conversion (e.g., receiving USD from a customer paying in EUR), PayPal applies a currency conversion spread or fee. This is often built into the exchange rate they offer.

4. Chargeback Fees

If a customer disputes a transaction and initiates a chargeback (usually through their bank or credit card company), PayPal may charge a fee to cover the administrative costs of the dispute. This fee is typically higher than standard transaction fees and is charged whether you win or lose the dispute. If you win the dispute, the fee is usually refunded.

5. PayPal Seller Protection

While not a fee, it’s important to understand PayPal’s Seller Protection policy. If your transaction qualifies, it can protect you from chargebacks and unauthorized transaction claims, which can save you significant money and hassle.

6. Other Fees

Depending on your account type and location, there might be other fees, such as withdrawal fees (though often free for standard withdrawals to linked bank accounts in many regions), fees for receiving payments in certain currencies, or fees for commercial payments if you’re not registered as a business.

It’s crucial to consult PayPal’s official fee pages for your specific region for the most up-to-date and accurate information. However, having a quick and easy way to calculate these on your own site is a game-changer.

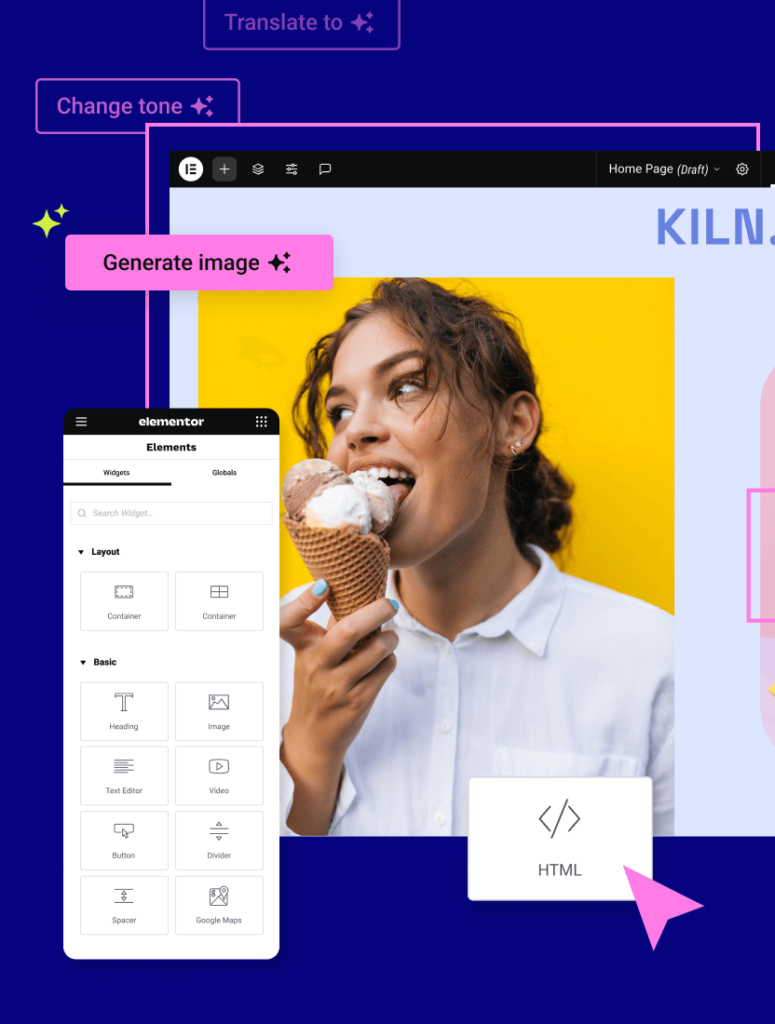

Introducing Your Elementor-Optimized PayPal Fee Calculator

Our PayPal Fee Calculator is designed to be an intuitive and powerful tool for every Elementor website owner. We understand that managing an online business involves many moving parts, and we aim to simplify at least one of them. This calculator takes the guesswork out of PayPal fees, allowing you to focus on what you do best: creating, selling, and growing.

The calculator is built with the flexibility and ease of use that Elementor is known for. You can easily embed it into your website, making it accessible to you and your team, or even to your customers if you wish to provide transparency. Whether you’re using Elementor’s drag-and-drop interface to design your site or looking for robust tools to enhance your business operations, this calculator integrates seamlessly.

For those who appreciate the power of creating custom solutions, our tool can be further customized. If you’re comfortable with a bit of code, you can explore tools like the HTML Viewer to ensure perfect integration and presentation. Elementor’s commitment to empowering creators extends to providing tools that support business functionality, much like the helpful Business Name Generator for those just starting out.

How Our PayPal Fee Calculator Works: A Simple 3-Step Process

We’ve engineered our PayPal Fee Calculator to be as straightforward as possible. You don’t need to be a financial expert or a coding whiz to use it effectively. Follow these three simple steps:

Step 1: Enter the Transaction Amount

The first and most crucial step is to input the total amount of the payment you received or are expecting to receive via PayPal. This should be the gross amount before any deductions. Simply locate the input field labeled “Transaction Amount” and type in the numerical value. Be precise to ensure the most accurate calculation.

Step 2: Select Relevant Options (Optional but Recommended)

Our calculator is designed to accommodate various scenarios. You’ll find options to indicate if the transaction is international or if it involves currency conversion. By checking these boxes, you allow the calculator to apply the relevant additional fees, giving you a comprehensive overview of the total cost. For instance, if you’re selling to a customer in another country, check the “International Transaction” box.

Step 3: View Your Calculated PayPal Fees and Net Amount

Once you’ve entered the transaction amount and selected any relevant options, simply click the “Calculate” button. Instantly, the calculator will display the estimated PayPal fees for that specific transaction. It will also show you the net amount you will receive after the fees have been deducted. This clear breakdown allows for immediate understanding of your profit per transaction.

This effortless process empowers you to quickly assess the financial impact of any PayPal transaction, making it an essential tool for daily operations and strategic planning.

Leveraging the PayPal Fee Calculator for Business Growth

The benefits of using a PayPal Fee Calculator extend far beyond simply knowing how much you’ll be charged. It can be a powerful catalyst for business growth when used strategically:

- Optimize Pricing Strategies: By understanding the exact fees, you can adjust your pricing to ensure healthy profit margins. You might discover that you can slightly increase prices without affecting sales volume, or conversely, identify areas where competitive pricing is possible by minimizing fee impact.

- Improve Cash Flow Forecasting: Accurate fee calculations lead to more reliable cash flow projections. This helps in planning for investments, managing operational expenses, and ensuring you always have sufficient funds available.

- Enhance Customer Experience (Indirectly): While you might not directly pass on fees, understanding them allows you to offer more competitive overall pricing. This can lead to increased customer satisfaction and loyalty.

- Streamline Accounting: Integrating this tool into your workflow simplifies expense tracking. Instead of manual calculations or searching through PayPal statements, you have immediate figures ready for your accounting records.

- Informed Decision-Making: Whether it’s deciding on a new product line, a marketing campaign, or expanding into international markets, having a clear grasp of payment processing costs is fundamental to making sound business decisions.

For businesses that prioritize accessibility and inclusivity, Elementor also offers tools like Ally Web Accessibility, ensuring your website is usable by everyone. Similarly, for those looking to build a strong online presence, reliable web hosting is crucial, and solutions like Elementor Hosting are designed to support your growth.

Tips for Minimizing PayPal Fees

While our calculator helps you understand and account for fees, it’s also beneficial to know how to potentially minimize them. Here are a few tips:

- Encourage Friends & Family Payments (for personal use only): For personal transactions where you’re not selling goods or services, using the “Friends & Family” option often incurs lower or no fees. However, it’s crucial to remember that using this for business transactions violates PayPal’s terms of service and can lead to account restrictions.

- Process Payments in Your Primary Currency: If possible, encourage transactions in your business’s primary currency to avoid currency conversion fees.

- Understand Your PayPal Account Type: Ensure you are using the correct PayPal account type for your business. Business accounts offer features and protections tailored for merchants.

- Review PayPal’s Business Resources: PayPal itself offers resources and sometimes promotional offers for businesses that can help reduce costs or provide benefits.

- Consider Alternative Payment Methods: Depending on your business model and customer base, exploring other payment gateways might reveal options with different fee structures that could be more advantageous. However, the convenience and reach of PayPal often make it a primary choice.

Our PayPal Fee Calculator provides the data you need to evaluate these strategies effectively.

The Elementor Advantage: Seamless Integration

For website owners who have embraced the power and flexibility of Elementor, integrating our PayPal Fee Calculator is a natural extension of their digital toolkit. Elementor is renowned for its user-friendly interface and its ability to transform a WordPress website into a professional, high-converting online presence. This calculator is designed to complement that experience.

By embedding this tool directly onto your website, you create a valuable resource that enhances user experience and provides immediate utility. Imagine having a “Calculate Your PayPal Fee” section on your pricing page or within your customer support resources. This level of transparency and helpfulness can significantly boost customer trust and engagement.

Furthermore, with Elementor’s constant innovation, including advanced features for managing content and designing user interfaces, integrating tools like our calculator ensures your website remains a dynamic hub for both information and functionality. For those looking to push the boundaries of their website’s capabilities, exploring Elementor’s AI-powered features with Elementor AI can unlock new levels of creativity and efficiency in content generation and design.

Who Can Benefit from the PayPal Fee Calculator?

The versatility of this tool makes it beneficial for a wide array of online professionals and businesses:

- E-commerce Store Owners: Accurately calculate fees on every sale to maintain profit margins.

- Freelancers and Consultants: Determine the net income from project payments, crucial for managing personal finances and setting future rates.

- Online Course Creators: Understand the deduction on enrollment fees, helping to price courses effectively.

- Digital Product Sellers: Calculate fees on software, e-books, templates, and other digital goods.

- Non-Profit Organizations: Track processing fees on donations to ensure maximum funds reach their intended purpose.

- Affiliate Marketers: Estimate the net earnings from affiliate commissions processed via PayPal.

- Small Business Owners: Manage transaction costs for services, invoices, and online orders.

Essentially, anyone who receives or sends money through PayPal for goods and services can benefit from the clarity and accuracy our PayPal Fee Calculator provides.

Conclusion: Empower Your Financial Future with Precision

In the competitive digital marketplace, every dollar counts. The PayPal Fee Calculator is more than just a convenient tool; it’s an essential component of smart financial management for any online business. By providing instant, accurate calculations of PayPal fees, it empowers you to make informed decisions about pricing, budgeting, and overall business strategy.

Integrated seamlessly into the Elementor ecosystem, this calculator offers the ease of use and powerful functionality that Elementor users have come to expect. Take control of your earnings, eliminate financial uncertainties, and pave the way for sustainable growth. Start using the PayPal Fee Calculator today and unlock the full potential of your online revenue!