Your Essential Sales Tax Calculator for Elementor Websites

Navigating the complexities of sales tax can feel like a labyrinth, especially for online businesses operating across different jurisdictions. Whether you’re a seasoned e-commerce entrepreneur or just starting your journey on your Elementor website, ensuring accurate sales tax collection is paramount. This is where a reliable Sales Tax Calculator becomes your indispensable ally. At Elementor, we understand the challenges you face, and we’ve developed a powerful, user-friendly tool designed to simplify this crucial aspect of your business operations.

In this comprehensive guide, we’ll delve deep into why a Sales Tax Calculator is a must-have for your online store, how it seamlessly integrates with your Elementor-powered website, and how to use it effectively. We’ll also explore the ever-changing landscape of sales tax regulations and how staying informed can protect your business.

Why You Need a Sales Tax Calculator

Sales tax is not a one-size-fits-all concept. It varies significantly from state to state, county to county, and even city to city within the United States, and similar complexities exist internationally. For online sellers, the “nexus” concept – the physical presence or economic activity that requires you to collect and remit sales tax in a particular state – can be particularly confusing. The South Dakota v. Wayfair, Inc. Supreme Court decision in 2018 further complicated matters by allowing states to require out-of-state retailers to collect sales tax based on economic nexus, even without a physical presence.

Failure to collect and remit the correct amount of sales tax can lead to significant penalties, back taxes, and damage to your business’s reputation. This is where a robust Sales Tax Calculator steps in. It automates the process of determining the correct tax rate based on the buyer’s location, ensuring compliance and saving you from potential financial and legal headaches.

Key Benefits of Using a Sales Tax Calculator:

- Ensures Compliance: Automatically applies the correct sales tax rates based on location, preventing under- or over-collection.

- Saves Time: Eliminates the manual effort of looking up tax rates for every transaction, freeing up your time for more strategic business activities.

- Reduces Errors: Minimizes human error in tax calculations, which can be costly.

- Boosts Customer Trust: Transparent and accurate tax calculations build trust with your customers.

- Scalability: As your business grows and expands into new markets, the calculator can easily handle new tax requirements.

- Peace of Mind: Knowing your sales tax obligations are being met correctly provides invaluable peace of mind.

How Our Sales Tax Calculator Works (in 3 Simple Steps)

We’ve designed our Sales Tax Calculator to be incredibly intuitive and efficient. Here’s how it simplifies sales tax calculation for your Elementor website:

Step 1: Input Customer Location and Purchase Details

When a customer proceeds to checkout on your Elementor website, our Sales Tax Calculator seamlessly prompts for their shipping address. This is the most critical piece of information. Depending on your website’s configuration and the specific features you’ve enabled, it might also ask for product-specific taxability information if certain items are exempt from sales tax in particular regions. For instance, some states exempt groceries or clothing below a certain price point from sales tax. Our tool is sophisticated enough to handle these nuances.

Step 2: Real-Time Tax Rate Lookup and Calculation

Once the customer’s location is provided, our Sales Tax Calculator instantly accesses an up-to-date database of sales tax rates. This database is regularly updated to reflect changes in local tax laws and rates across thousands of jurisdictions. It then calculates the exact sales tax applicable to the customer’s order based on their validated shipping address and the total purchase amount. This real-time lookup ensures that you are always applying the most current and accurate tax rate available.

Step 3: Display and Apply Tax to the Order Total

The calculated sales tax amount is then clearly displayed to the customer on their order summary before they complete the purchase. This transparency is key to a positive customer experience. Finally, the calculated tax is added to the subtotal, providing the final order total. This amount is what you will collect from the customer and is ready for remittance to the relevant tax authorities.

Integrating the Sales Tax Calculator with Your Elementor Website

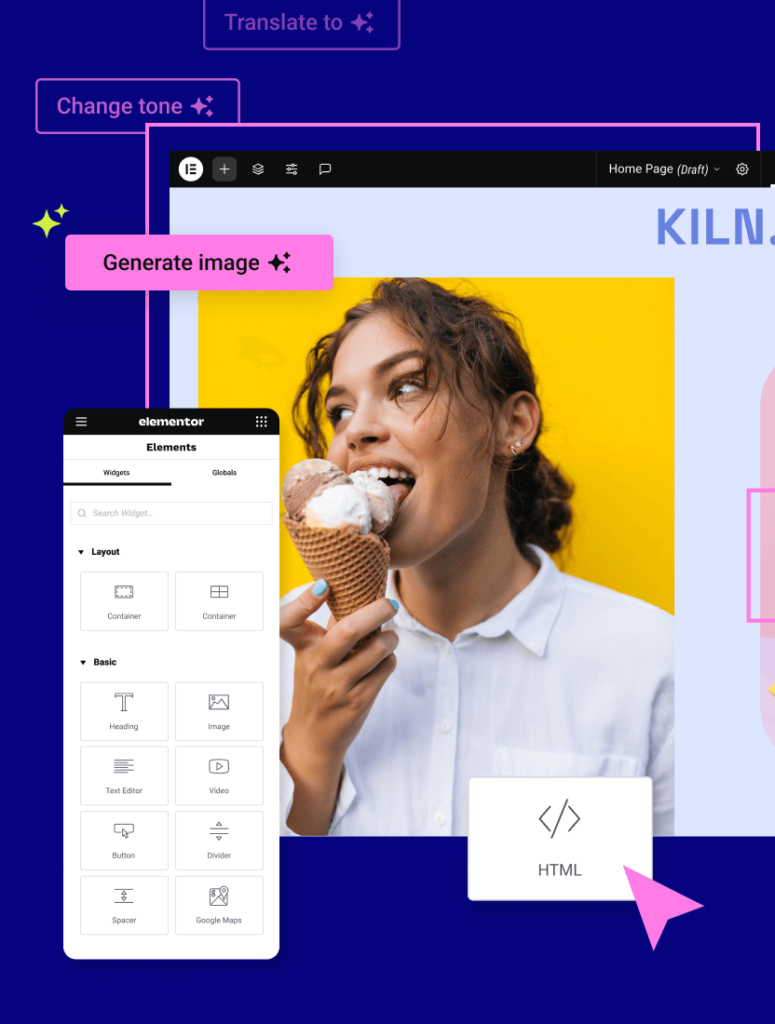

Elementor, the leading website builder for WordPress, offers unparalleled flexibility and control over your website’s design and functionality. Integrating our Sales Tax Calculator is a seamless process, designed to enhance your e-commerce capabilities without requiring complex coding. We aim to make your website as powerful as possible, just like our other tools, such as the Business Name Generator, which helps you find the perfect identity for your brand.

For Elementor users, this means the Sales Tax Calculator isn’t just an add-on; it’s a core component that can be styled to match your website’s aesthetic perfectly. You can place it strategically within your checkout flow, ensuring it’s visible and accessible to your customers at the right moment. Whether you’re using Elementor’s theme builder or its robust page editing capabilities, the integration is designed to be as straightforward as possible, allowing you to focus on selling, not on technical configurations.

The beauty of building with Elementor is the visual drag-and-drop interface. When you add our Sales Tax Calculator to your checkout page, you’re not dealing with lines of code. You’re using intuitive widgets that allow you to control placement, styling, and integration points with your e-commerce platform. This makes it accessible even for those who aren’t deeply technical.

Understanding Sales Tax Nexus for Online Sellers

As an online seller, understanding where you have a sales tax obligation (nexus) is critical. Historically, nexus was primarily based on physical presence – having an office, warehouse, or employees in a state. However, the landscape has shifted dramatically.

Economic Nexus: A Game Changer

Following the Wayfair decision, many states have enacted economic nexus laws. These laws require businesses to collect and remit sales tax if their sales into a state exceed a certain threshold, typically a dollar amount (e.g., $100,000) or a number of transactions (e.g., 200) within a calendar year. This means that even if you have no physical presence in a state, you could still be required to collect sales tax if your sales volume reaches their threshold.

This is where a dynamic Sales Tax Calculator is essential. It doesn’t just rely on a single, fixed rate. It dynamically checks the customer’s location against these varying state and local rules, including economic nexus thresholds, to determine the correct tax liability. Keeping track of these thresholds manually for every state you sell into would be an overwhelming task.

Remote Seller Nexus and Compliance

Many states now have specific provisions for remote sellers. Our Sales Tax Calculator is designed to stay updated with these evolving regulations. It helps you identify which states you likely have nexus in based on your sales data and apply the appropriate tax rates accordingly. This proactive approach to compliance is vital for long-term business sustainability.

For instance, if you’re based in California but make sales to customers in Texas, and your Texas sales exceed their economic nexus threshold, you are obligated to collect Texas sales tax. Our calculator will automatically identify this and apply the correct Texas state and local taxes to those specific orders.

Beyond Basic Calculation: Advanced Features and Considerations

While accurate calculation is the primary function, a truly effective Sales Tax Calculator offers more:

Product Taxability

Some products are taxed differently depending on the state. For example, software subscriptions might be taxed as a service in one state and as a product in another. Certain food items might be tax-exempt in some areas but taxable in others. Our Sales Tax Calculator can be configured to handle these product-specific taxability rules, ensuring you don’t miscalculate based on the nature of the goods you sell. This level of detail is crucial for businesses selling a diverse range of products.

Tax-Exempt Customers

Your business might sell to organizations that are exempt from paying sales tax, such as non-profits or government agencies. A robust Sales Tax Calculator can be integrated with your customer management system to identify tax-exempt customers and automatically waive sales tax for their orders, provided you have the necessary documentation on file.

Shipping Taxability

The taxability of shipping charges also varies by state. In some states, shipping is taxable if the item being shipped is taxable. In others, shipping is always tax-exempt. Our calculator can be configured to adhere to these state-specific rules for shipping taxability.

Location Accuracy

The accuracy of the calculation hinges on the accuracy of the location data. Our tool often integrates with address validation services to ensure that the customer’s address is correctly formatted and recognized, reducing the risk of misapplied tax rates due to incorrect addresses.

Why Elementor is the Ideal Platform for Your Sales Tax Solution

Elementor provides a powerful and flexible foundation for building and managing your online store. Its intuitive interface and extensive widget library mean you can customize every aspect of your website, including your checkout process and sales tax management. This flexibility allows you to seamlessly integrate a Sales Tax Calculator that not only functions perfectly but also aligns with your brand’s visual identity.

When you build with Elementor, you have the power to create sophisticated user experiences. This extends to your e-commerce checkout. You can easily add and configure the Sales Tax Calculator, ensuring it’s presented clearly to your customers. The visual editing capabilities mean you can style the tax display exactly how you want it, making it a natural part of the checkout flow, not an afterthought. This level of control is what sets Elementor apart. For example, if you’re exploring advanced website features, you might find our Elementor AI incredibly useful for generating content that complements your products, or our Ally Web Accessibility tool to ensure your site is usable by everyone.

Furthermore, Elementor’s commitment to performance and optimization means that integrating tools like our Sales Tax Calculator won’t slow down your website. A fast and efficient checkout process is crucial for converting visitors into customers. And for those looking for a complete hosting solution, Elementor Hosting provides a stable and optimized environment for your website.

Staying Ahead of Sales Tax Changes

The world of sales tax is constantly evolving. New states adopt economic nexus laws, tax rates change, and specific product taxabilities are updated. Relying on a manual system or outdated information is a recipe for disaster. A reputable Sales Tax Calculator, like the one offered with Elementor, is continuously updated to reflect these changes.

This means you don’t have to spend hours researching tax law changes. Our tool’s underlying database is maintained by experts who monitor these developments. This ensures your compliance efforts remain up-to-date without requiring constant manual intervention. For instance, if a new tax rule is implemented in a state where you have sales, our calculator will automatically incorporate that change, so your next order from that state is calculated correctly.

Consider the complexity of managing sales tax if you sell internationally. While this article primarily focuses on US sales tax, the principles of accurate calculation and staying updated are global. A well-maintained Sales Tax Calculator is your first line of defense against compliance issues, regardless of your geographic reach.

Frequently Asked Questions About Sales Tax Calculators

Q1: Does the Sales Tax Calculator handle international sales tax?

Our primary focus is on providing accurate US sales tax calculations, including state, county, and local taxes, and addressing economic nexus. For international sales tax, which involves Value Added Tax (VAT) or Goods and Services Tax (GST) and different customs regulations, additional solutions or configurations might be required depending on the specific countries you operate in.

Q2: How often are the sales tax rates updated?

Our Sales Tax Calculator leverages a continuously updated database. Tax rates and regulations are monitored and updated in real-time or on a very frequent basis to ensure accuracy, reflecting changes made by tax authorities.

Q3: Can I customize tax rates for specific products or customers?

Yes, our calculator is designed with flexibility in mind. You can typically configure product taxability rules for items that have varying tax treatment across different jurisdictions. Additionally, you can often set up exemptions for specific customer types, such as tax-exempt organizations.

Q4: What if I sell in multiple states?

This is precisely where a Sales Tax Calculator is most beneficial. It automatically identifies the customer’s location and applies the correct tax rate based on your nexus obligations and that specific jurisdiction’s rules. You don’t need to manually track rates for each state.

Q5: Is the Sales Tax Calculator integrated with my Elementor website’s checkout?

Absolutely. The integration is designed to be seamless within your Elementor-built website. It works as part of your e-commerce checkout process, ensuring that tax is calculated and displayed to your customers before they finalize their purchase.

Conclusion: Empower Your Business with Accurate Sales Tax Calculation

In the dynamic world of e-commerce, precision in sales tax collection is not optional; it’s a fundamental requirement for responsible business operation. By leveraging a powerful and user-friendly Sales Tax Calculator, you can automate this complex process, ensure compliance, save valuable time, and build greater trust with your customers. The seamless integration with your Elementor website means you get a robust solution that looks and feels like a native part of your brand.

Don’t let sales tax complexities hinder your business growth. Invest in a reliable Sales Tax Calculator and focus on what you do best – creating amazing products and services for your customers. Streamline your operations, mitigate risks, and gain peace of mind. Start using our Sales Tax Calculator today and take control of your sales tax obligations with confidence.